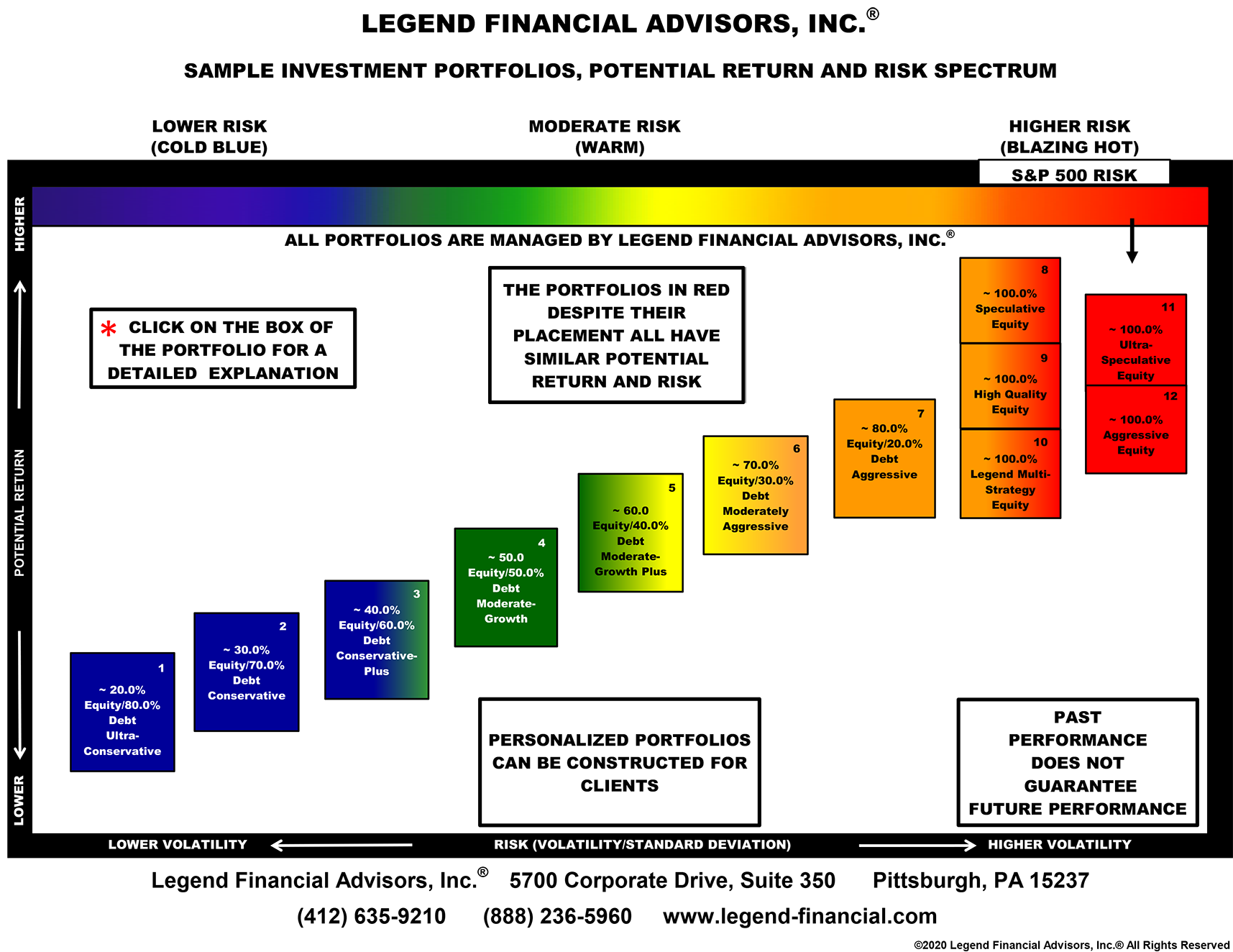

Risk Spectrum

#1

∼ 20.0% EQUITY / 80.0% DEBT ULTRA-CONSERVATIVE PORTFOLIO

Investment Strategy:

The ∼ 20.0% equity / 80.0% debt ultra-conservative portfolio has an approximate long-term target allocation of 20.0% in equities and 80.0% in debt (interest generating) investments. The allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year), intermediate term (one to five years) or change the allocation dramatically for defensive purposes (for example: in a recession) or for offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to; high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to: domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of being ultra-conservative. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#2

∼ 30.0% EQUITY / 70.0% DEBT CONSERVATIVE PORTFOLIO

Investment Strategy:

The ∼ 30.0% equity / 70.0% debt conservative portfolio has an approximate long-term target allocation of 30.0% in equities and 70.0% in debt (interest ∼ generating) investments. The allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year) and intermediate term (one to five years) or change the allocation dramatically for defensive purposes (for example: in a recession) or offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to; high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to: domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of being conservative. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#3

∼ 40.0% EQUITY / 60.0% DEBT CONSERVATIVE-PLUS PORTFOLIO

Investment Strategy:

The ∼ 40.0% equity / 60.0% debt conservative-plus portfolio has an approximate long-term target allocation of 40.0% in equities and 60.0% in debt (interest generating) investments. The allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year) and intermediate term (one to five years) or change dramatically for defensive purposes (for example: in a recession) or offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to: high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to; domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of being somewhat conservative. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#4

∼ 50.0% EQUITY / 50.0% DEBT MODERATE-GROWTH PORTFOLIO

Investment Strategy:

The ∼ 50.0% equity / 50.0% debt moderate-growth portfolio has an approximate long-term target allocation of 50.0% in equities and 50.0% in debt (interest generating) investments. The allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year) and intermediate term (one to five years) or change the allocation dramatically for defensive purposes (for example: in a recession) or offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to: high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to; domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of being somewhat focused on growth while not being overly aggressive. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#5

∼ 60.0% EQUITY / 40.0% DEBT MODERATE-GROWTH PLUS PORTFOLIO

Investment Strategy:

The ∼ 60.0% equity / 40.0% debt moderate-growth plus portfolio has an approximate long-term target allocation of 60.0% in equities and 40.0% in debt (interest generating) investments. The allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year) and intermediate term (one to five years) or change the allocation dramatically for defensive purposes (for example: in a recession) or offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to: high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to; domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on growth while not being overly aggressive. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#6

∼ 70.0% EQUITY / 30.0% DEBT MODERATELY AGGRESSIVE PORTFOLIO

Investment Strategy:

the ∼ 70.0% equity / 30.0% debt moderately aggressive portfolio has an approximate long-term target allocation of 70.0% in equities and 30.0% in debt (interest generating) investments. The allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year) and intermediate term (one to five years) or change the allocation dramatically for defensive purposes (for example: in a recession) or offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to; high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to: domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on above average growth while accepting above average risk. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#7

∼ 80.0% EQUITY / 20.0% DEBT AGGRESSIVE PORTFOLIO

Investment Strategy:

The ∼ 80.0% equity / 20.0% debt aggressive portfolio has an approximate long-term target allocation of 80.0% in equities and 20.0% in debt (interest generating) investments. the allocation to either asset class can sometimes fluctuate upward or downward from the long-term target allocation in the short term (less than one year) or intermediate term (one to five years) or change the allocation dramatically for defensive purposes (for example: in a recession) or offensive purposes.

Primary Investments:

Debt-type income (interest generating) investments may include, but are not limited to; high quality, medium quality, and/or lower quality securities (example: high-yield bonds). Debt-type income investments can include traditional domestic fixed (U.S. government agency and bond-type securities as well as corporate bonds) and variable rate securities such as floating rate instruments (bonds, mortgages and bank loans) and/or money market type securities (cash or near cash-like investments). Other debt-type securities can also include currencies, municipals as well as foreign (including emerging market) debt-type income securities.

For the equity portion of the portfolio, the investments can include, but are not limited to: domestic, foreign and emerging market as well as real estate equities or equity-like securities. The portfolio also utilizes some of the following: commodities, hedge-type-like, sector and/or subsector investment strategies as well as other similar-type investments.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on aggressive growth while accepting a high level of risk. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise or fall periodically and perhaps substantially.

Past investment performance is not a guarantee of future performance.

#8

∼ 100.0% EQUITY SPECULATIVE PORTFOLIO

Investment Strategy:

The ∼ 100.0% equity speculative portfolio has a target overall allocation of approximately 100.0% in equity investments. The allocation to equities can fluctuate as well as change dramatically, if necessary, to protect the principal in a near bear or bear market downturn making the portfolio more conservative. The portfolio will normally be aggressive by owning various types of equities.

Primary Investments:

The equity portion of the investments may include, but are not limited to: domestic, foreign and emerging markets as well as real estate equities or equity-like securities that invest in, commodities, hedge-type, sector and/or subsector investment strategies.

The portfolio is not expected to frequently own debt-type income investments. When they are owned, they may include a number of different types of debt securities, both fixed and variable, which will be held with the goal of protecting the portfolio.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities.

Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on very aggressive growth while accepting a significant level of risk. however, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise periodically and perhaps substantially.

Past performance does not guarantee future performance.

#9

∼ 100.0% EQUITY HIGH QUALITY PORTFOLIO

Investment Strategy:

The ∼ 100.0% equity high quality portfolio has an approximate target overall allocation of 100.0% in high quality equity investments. high quality equities are typically those that have low valuations relative to the stock market, consistent growth of earnings, low leverage (low amount of debt) and offers at least a market-level of dividends (similar to the s&p 500). this type of portfolio tends to be value and/or growth-at-a-price-oriented.

The allocation to equities can decline or change dramatically, if necessary, to protect the principal in a near bear or bear market downturn making the portfolio more conservative. alternatively, the portfolio can hold 100.0% in equities.

From time to time, the portfolio will own either some or all of the following type equity asset classes: large, medium, small size equities as well as those that focus on value, growth-at-a-price and growth investment strategies.

Primary Investments:

The equity portion of the investment portfolio may include, but are not limited to: equities or equity-like securities that invest in domestic, foreign, emerging markets, hedge-type, sector and/or subsector investment strategies.

The portfolio is not expected to frequently own debt-type income investments. When they are owned, they may include a number of different types of debt securities, both fixed and variable which will be held to assist in protecting the portfolio.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

In addition, in order to protect the portfolio, securities that short the stock market or certain sectors of the stock market may be purchased.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note almost all investments will be individual stocks. occasionally, the portfolio may include open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on very aggressive growth while accepting a significant level of risk. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise periodically and perhaps substantially.

Past performance does not guarantee future performance.

#10

∼ 100.0% EQUITY LEGEND MULTI-STRATEGY PORTFOLIO

Investment Strategy:

The ∼ 100.0% equity Legend multi-strategy portfolio has a target overall allocation of approximately 100.0% in equity investments. The allocation to equities can fluctuate as well as change dramatically, if necessary, to protect the principal in a near bear or bear market downturn making the portfolio more conservative or become more aggressive by owning varying percentages of leveraged equities (these funds borrow money within the product) at times. this will be accomplished by utilizing leveraged etf (exchange-traded funds) and etn (exchange-traded notes) products.

Primary Investments:

The equity portion of the investment portfolio may include, but are not limited to: equities or equity-like securities that invest in domestic, foreign, emerging markets, commodities, hedge-type, sector and/or subsector investment strategies. At times, in periods of low valuations or unique investment opportunities, when available, the portfolio may buy leveraged etfs or etns or other types of mutual funds that use leverage, thereby making the portfolio more aggressive.

The portfolio is not expected to frequently own debt-type income investments. When they are owned, they may include a number of different types of debt securities, both fixed and variable, which will be held with the goal of protecting the portfolio.

From time to time, defensive measures may be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. The company may also use various shorting techniques in order to avoid selling securities with larger capital gains, utilizing investments that may counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Please note most investments will be individual stocks. Usually, the portfolio will also include some open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on very aggressive growth while accepting a significant level of risk. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise periodically and perhaps substantially.

Past performance does not guarantee future performance.

#11

∼ 100.0% EQUITY ULTRA-SPECULATIVE PORTFOLIO

Investment Strategy:

The ∼ 100.0% equity ultra-speculative portfolio has an approximate target overall allocation of 100.0% in equity investments. The allocation to equities can fluctuate as well as change dramatically, if necessary, to protect the principal in a near bear or bear market downturn making the portfolio more conservative or become more aggressive by owning varying percentages of leveraged equities (these funds borrow money within the product) at times. this will be accomplished by utilizing leveraged etf (exchange-traded funds) and etn (exchange-traded notes) products.

In addition, the portfolio will periodically use investments that may be held for very short time periods. in some cases, investments may be held for as little as a few days in an attempt to capture short-term profit opportunities.

Primary Investments:

The equity portion of the investment portfolio may include, but are not limited to: equities or equity-like securities that invest in domestic, foreign, emerging markets, commodities, hedge-type, sector and/or subsector investment strategies. The portfolio may also incorporate single country and/or regional-type mutual funds, etfs and etns.

At times, in periods of low valuations or unique investment opportunities, when available, the portfolio may buy leveraged etfs or etns or other types of mutual funds that use leverage, thereby making the portfolio more aggressive.

The portfolio is not expected to frequently own debt-type income investments. When they are owned, they may include a number of different types of debt securities, both fixed and variable, which will be held with the goal of protecting the portfolio.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

The company might also implement stop losses on some or all of the securities in the portfolio.

Usually, the portfolio will include open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns). Please note on occasion that some investments will be individual stocks.

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on very aggressive growth while accepting a significant level of risk. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise periodically and perhaps substantially.

Past performance does not guarantee future performance.

#12

∼ 100.0% EQUITY AGGRESSIVE PORTFOLIO

Investment Strategy:

The ∼ 100.0% equity aggressive portfolio has a target overall allocation of approximately 100.0% in equity investments. The allocation to equities can fluctuate as well as change dramatically, if necessary, to protect the principal in a near bear or bear market downturn making the portfolio more conservative or become more aggressive by owning varying percentages of leveraged equities (these funds borrow money within the product) at times. this will be accomplished by utilizing leveraged etf (exchange-traded funds) and etn (exchange-traded notes) products.

From time to time, the portfolio will own either some or all of the following type equity asset classes: large, medium, small size equities as well as those that focus on value, growth-at-a-price and growth investment strategies.

Primary Investments:

The equity portion of the investment portfolio may include, but are not limited to: equities or equity-like securities that invest in domestic, foreign, emerging markets, commodities, hedge-type, sector and/or subsector investment strategies. At times, in periods of low valuations or unique investment opportunities, when available, the portfolio may buy leveraged etfs or etns or other types of mutual funds that use leverage, thereby making the portfolio more aggressive.

The portfolio is not expected to frequently own debt-type income investments. When they are owned, they may include a number of different types of debt securities, both fixed and variable, which will be held with the goal of protecting the portfolio.

From time to time, defensive measures will be implemented to attempt to at least partially protect the portfolio from principal loss. These measures could include, but are not limited to liquidating investments and using the cash proceeds to purchase cash or money markets equivalents, buying U.S. government and/or U.S. government agency securities. Periodically, various shorting techniques will also be used to avoid selling securities with larger capital gains, utilizing investments that often counter losses in the domestic stock market (ex. gold) and/or employing investments that can potentially profit from increased market volatility.

Phe company might also implement stop losses on some or all of the securities in the portfolio.

Please note most investments will be individual stocks. Usually, the portfolio will also include some open-end mutual funds and/or exchange-traded funds (etfs) and/or notes (etns).

Important Notes:

The expected normal targeted long-term (10 to 15 years) volatility of the portfolio has a goal of focusing on very aggressive growth while accepting a significant level of risk. However, there are no guarantees of limits on volatility. Please note that volatility in the short-term may rise periodically and perhaps substantially.

Past performance does not guarantee future performance.